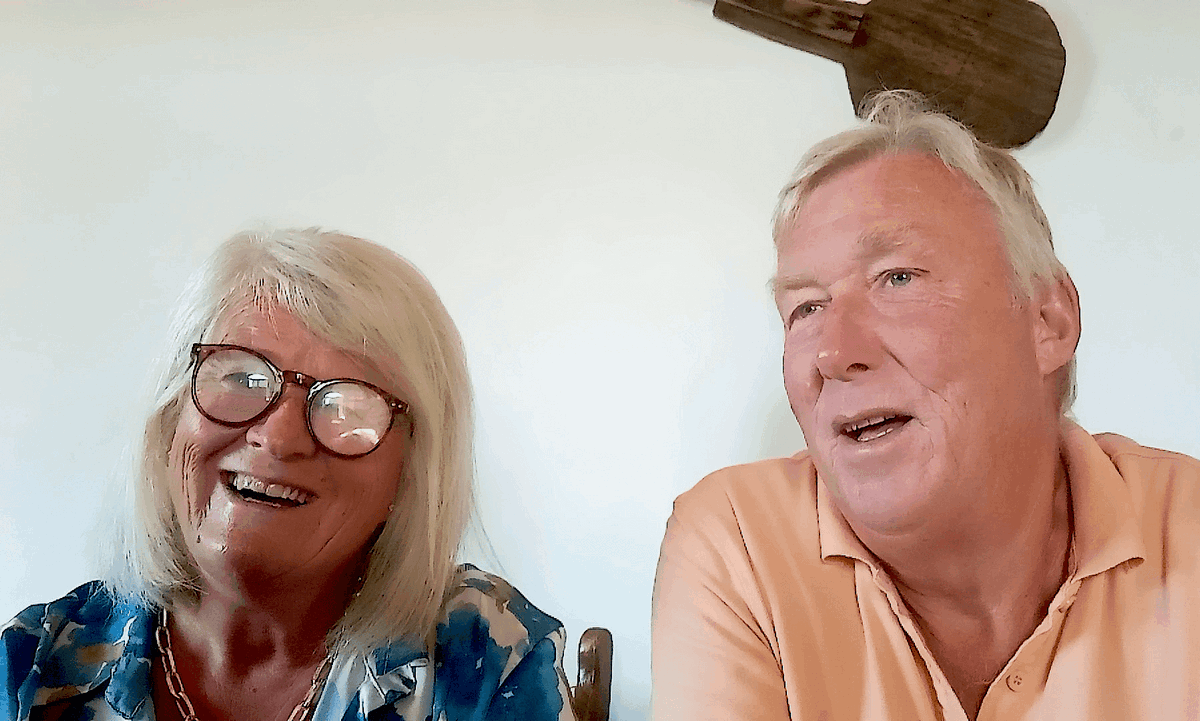

Couples planning for retirement

Your best years are ahead

As you approach retirement, securing your financial future is essential to enjoying the life you’ve worked so hard to achieve. Your money must work effectively and efficiently, allowing you to enjoy your retirement without financial worries.

So, it’s crucial to understand where you stand now and how your current situation aligns with your dreams for the future, and to discover if you’re on track to meet your goals.

Here to make things easier

Realising your vision

We begin by understanding where you both want to go in life. Whether it’s early retirement or pursuing a different path, we want to hear about your motivations and plans for the future.

A clear path forward

No matter your goals, you must identify a path to get there. We’ll create a clear retirement plan, tailored to your goals, so you can confidently achieve them over time.

Visualise Your Future

Our Visualise Your Future process gives you a clear picture of what's ahead. It shows different scenarios so you can see the advantages and disadvantages of each.

Ensure tax efficiency

We’ll review existing pensions and investments to ensure they're cost-effective, tax-efficient, and working as hard as possible for you to achieve your goals.

Remove uncertainty

We’re here as your Financial Planner, helping to lift the weight of uncertainty from your shoulders. We provide you with peace of mind so you can achieve your objectives.

Long-term support

Once everything is set up to meet your short-, medium- and long-term goals, we’ll stay by your side as your ongoing financial partner and have regular review meetings.

Working together

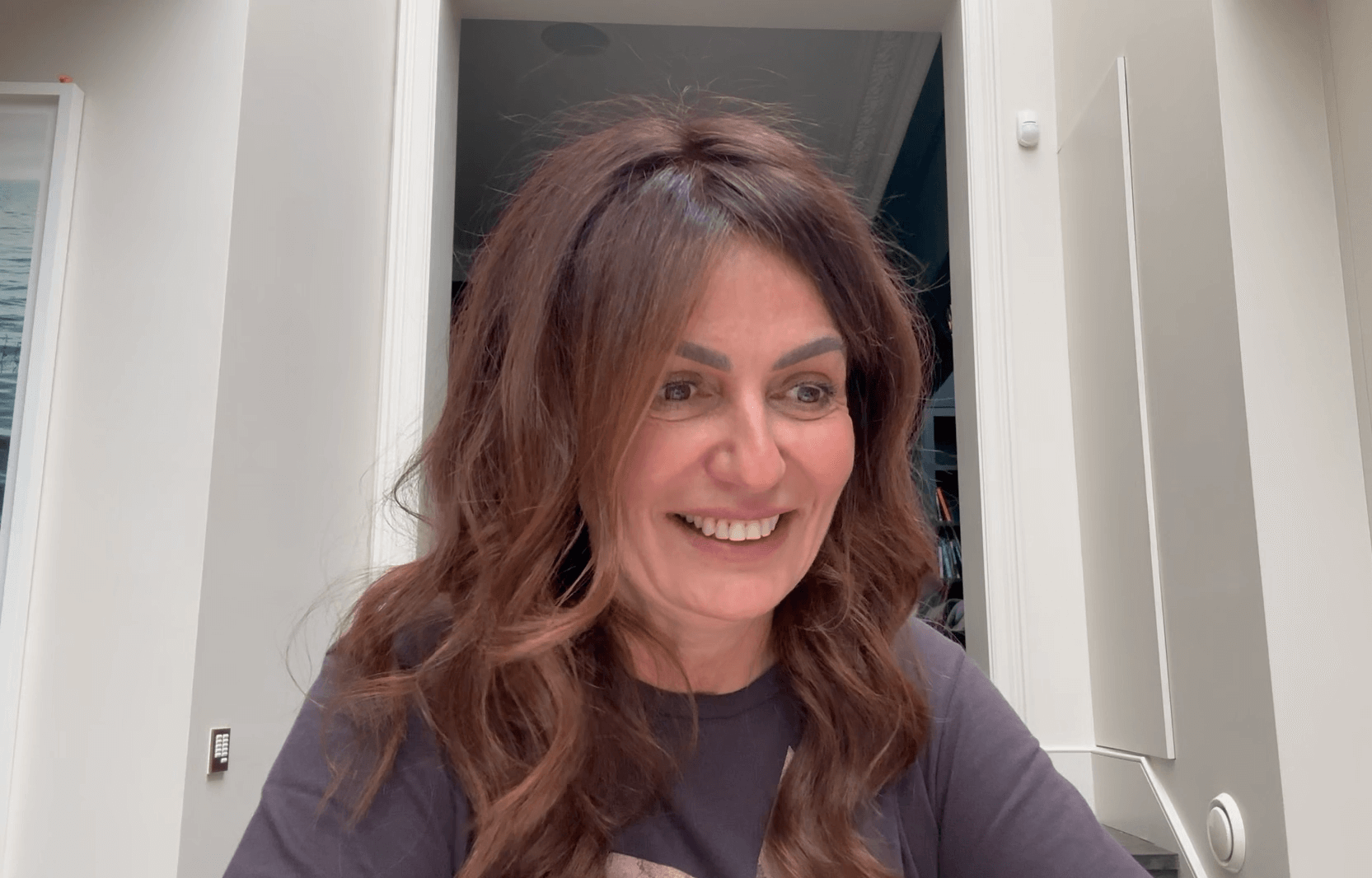

Hear from people in your shoes

We’ve got you covered

Find out moreHow can I book an initial meeting?

We have developed a two-step process to help you and Lottie learn whether you are right for each other. Initially, please answer the questions here about your circumstances. Then we’ll review your answers and if we feel Lottie might be the right Financial Planner for you, we’ll arrange a complimentary initial meeting.

How often should I meet with a Financial Planner?

It depends on your circumstances, but we recommend an annual review to ensure your plan stays on track. However, if you experience a major life event, such as a job change, marriage, divorce, or birth of a child, we may need to meet more frequently to adjust your financial plan.

How can I protect my family financially?

We offer advice on protection strategies, including life insurance, critical illness cover, and income protection. These plans ensure that if anything unexpected happens, your loved ones are financially secure and cared for.