Widowed women

You’re not alone

After losing a loved one, organising your finances may be the last thing on your mind. We understand how emotionally challenging this period is, and we’ll offer support and guidance at a pace that feels right for you.

Some matters will need to be addressed straight away, while others can wait until you’re in a better frame of mind. But you don’t have to navigate this alone; we’ll work through everything together, ensuring you’re supported every step of the way.

Here to make things easier

A clear path forward

Right now, having a clear plan could give you the structure and reassurance you need to feel hopeful about the future. We’ll sit down and listen to your goals – big or small – then identify a path to reach them.

Visualise Your Future

It may be difficult to think about what’s ahead but we’ll help you through this using our Visualise Your Future process. We’ll give you a clear picture of what's ahead and show different scenarios.

Remove uncertainty

We understand that financial worries can be overwhelming. The True team will hold your hand through this challenging time and help you remove any fears by providing clarity with a plan for the future.

Boost your knowledge

Empowering you with confidence is a cornerstone of our approach. Through educational resources, personalised guidance, and transparent communication, we'll help you gain control.

Analyse your estate

With so much on your plate, we’re here to lighten the load. We’ll review your estate, including existing investments and pensions, to ensure your money is working hard for you to meet your objectives.

Long-term support

We know how much our support can help you, so once everything is set up to meet your short- and long-term goals, we’ll stay by your side as your ongoing financial partner and have regular review meetings.

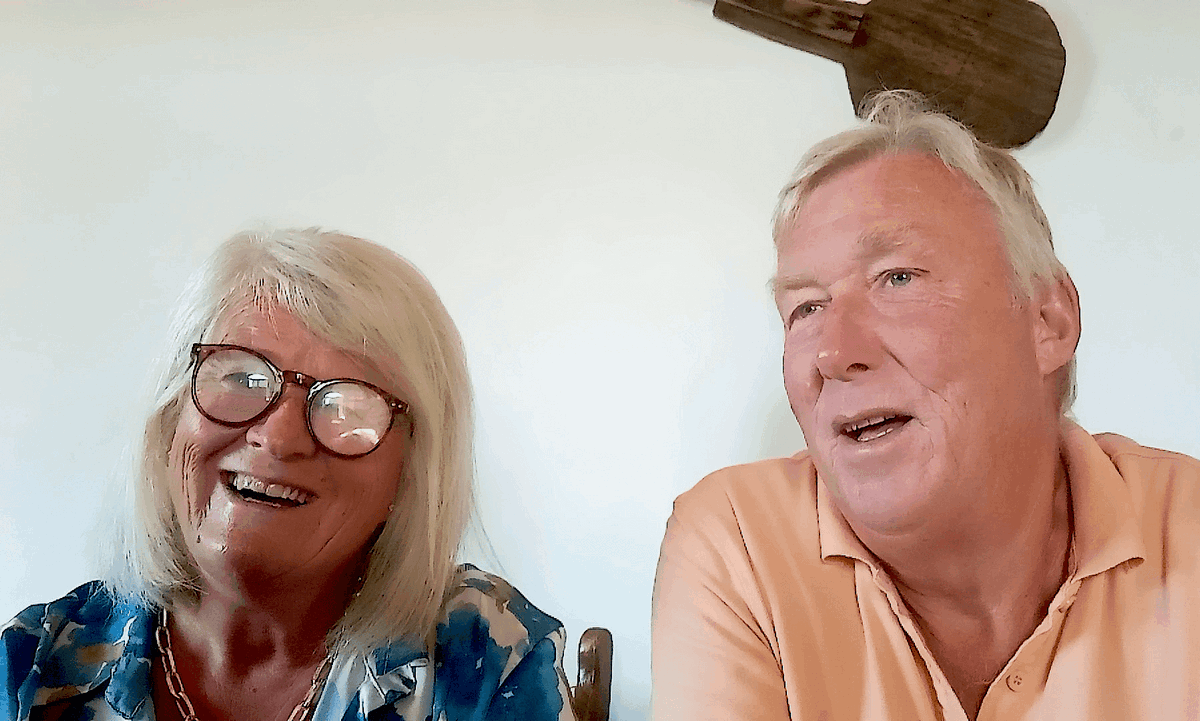

Working together

Hear from people in your shoes

We’ve got you covered

Find out moreWhy is financial planning different for women?

Women tend to face unique financial challenges, such as longer life expectancies, career breaks and wage disparities. These mean that financial plans must be flexible and comprehensive, ensuring women are prepared for retirement and other financial goals.

Do I need to be super wealthy to work with a Financial Planner?

Our services are designed for women at all stages of life and wealth levels. Whether you’re just starting to invest or need guidance managing an established portfolio, we can help create a plan that fits your needs and financial situation.

How can I protect my family financially?

We offer advice on protection strategies, including life insurance, critical illness cover, and income protection. These plans ensure that if anything unexpected happens, your loved ones are financially secure and cared for.